-

Helping African Governments improve

Business Climate, Internal Revenue and Transparency.

Mobile Taxation Solutions Mineral Traceability Solutions Versión en español.![]()

Founded in Chemnitz, Germany in 1991, ibes AG has been continuously innovating and evolving.

More than 50 engineers develop professional IT solutions in the field of IT Systems and Service Infrastructure; Software Engineering; Global Tracking and Tracing of Objects; Identity Management; Access and Time Management Solutions; and more.

ibes Good Governance Solutions is the specialised branch of ibes AG dedicated to design, development and implementation of Good Governance IT Solutions in Africa. Our team of experts share a passion for making the world a better place.

TaxOnPhone going live in Zambia!

After successful implementation and testing of our TaxOnPhone system at Zambia's Revenue Authority (ZRA), the country's first USSD tax service named TaxOnPhone (*858#) was officially released to all taxpayers on January 31, 2019!

Our Core Competencies

Good Financial Governance

We design and implement innovative solutions to a country's public finance problems in core processes such as tax administration, budgeting, tax/revenue collection.

Good Natural Resource Governance

Violence, human rights violations, child labour, smuggling and tax avoidance are some of the problems affecting global mineral supply chains. We help countries overcome these issues with innovative IT tools that make it easy to implement internationally accepted due dilligence guidances.

TaxOnPhone: Mobile

e-Taxation Platform.

Germany's Federal Ministry for Economic Cooperation and Development recognizes TaxOnPhone as an innovative solution to fiscal issues in developing countries

TaxOnPhone is a product developed with Africa in mind: A solution to address structural deficits in the collection of internal revenue, taking advantage of Africa's global lead in the adoption of mobile technologies to give citizens cheap and easy access to the Internal Revenue Authority in their country.

Because of its USSD text-based interface, TaxOnPhone is usable on virtually any cellphone: from the most modest model to the most advanced smartphone. With the included Electronic Fiscal Device (EFD) over USSD functions, TaxOnPhone can be a very powerful, cost-efficient tool for Tax Authorities around the world.

A unique USSD-Based Solution that allows Taxpayers and Internal Revenue Authorities to:

File

Taxes, Amendments, Document Requests and more. TaxOnPhone even provides Electronic Fiscal Device (EFD) functionality over USSD.

Pay

Fees, Royalties, Taxes, and more: Directly from a Mobile Wallet.

Integrate

With additional governmental services, to provide an all-mobile eGovernment solution.

Register

New Taxpayers, Cars, Taxis, Public transport operation fees, etc.

Analyze

Possible fiscal compliance violations, Trends, Transaction Volumes, amongst other valuable data insights.

Communicate

Directly with citizens, through TaxOnPhone's Bulk SMS capabilities.

Find out how TaxOnPhone can help increase tax revenue in your country:

Get in touch with our consultant team.

Read TaxOnPhone product brochure.

Raw Material

Trade Chain Certification:

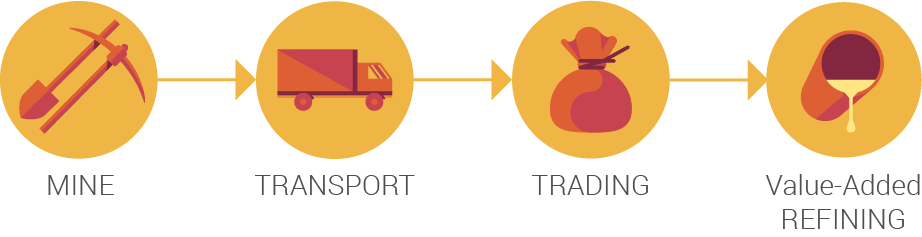

GOTS MineralTrace provides a law-conform technological platform and auditing/certification framework that implements a secure trade documentation and proof of origin system over the mineral/precious stones supply chain, following an open-market approach.

The GOTS MineralTrace solution is an innovative tool to achieve formalization of artisanal small-scale mining, raw material trade documentation, proof of origin and improvement of mineral royalties collection.

Artisanal and small-scale miners (ASM) get better prices for their production, governments perceive urgently-needed tax revenue, and industries in importing countries can reliably audit that their supply chains conform to local and international due dilligence law.

REAL-TIME TRADE MONITORING

Trade Documentation and Proof of Origin

Real-time monitoring of traded minerals from certified mine sites allow efficient on-the-ground assessment to identify compliant trade of gold and precious stones. This gives state institutions the tools needed to formalize ASM mining operations and improve tax and royalty collection. Thanks to our unique combination of highly secure and low-cost RFID tagging, rugged standard smartphones, offline operation capabilities, and a world-class geolocation web portal, GOTS MineralTrace for Gold has been successfully piloted and implemented in the African Great Lakes Region.

THE GOTS MINERALTRACE SOLUTION

The importance of certified and fair Mineral Trading Chains

Read the GOTS MineralTrace technical brochure to get more information on how our system is already helping formalize artisanal small-scale mining operations in Africa, and how MineralTrace can bring similar benefits to your country:

Read MineralTrace product brochure.Get In Touch

ibes AG

Bergstraße 55, 09113

Chemnitz, Germany

Phone: (49) 371 36 40

Email: info (at) ibes (dot) ag

ibes AG, founded in Germany in 1991, has been investing in the development of Africa for over 10 years: We have implemented Good Governance solutions in more than 10 African countries; including DRC, Zambia, Yemen, Chad, Nigeria, and more.